Get our insights delivered directly to your inbox

Sign up to the Finura DigestPensions carry forward: a quick guide for 2025/2026

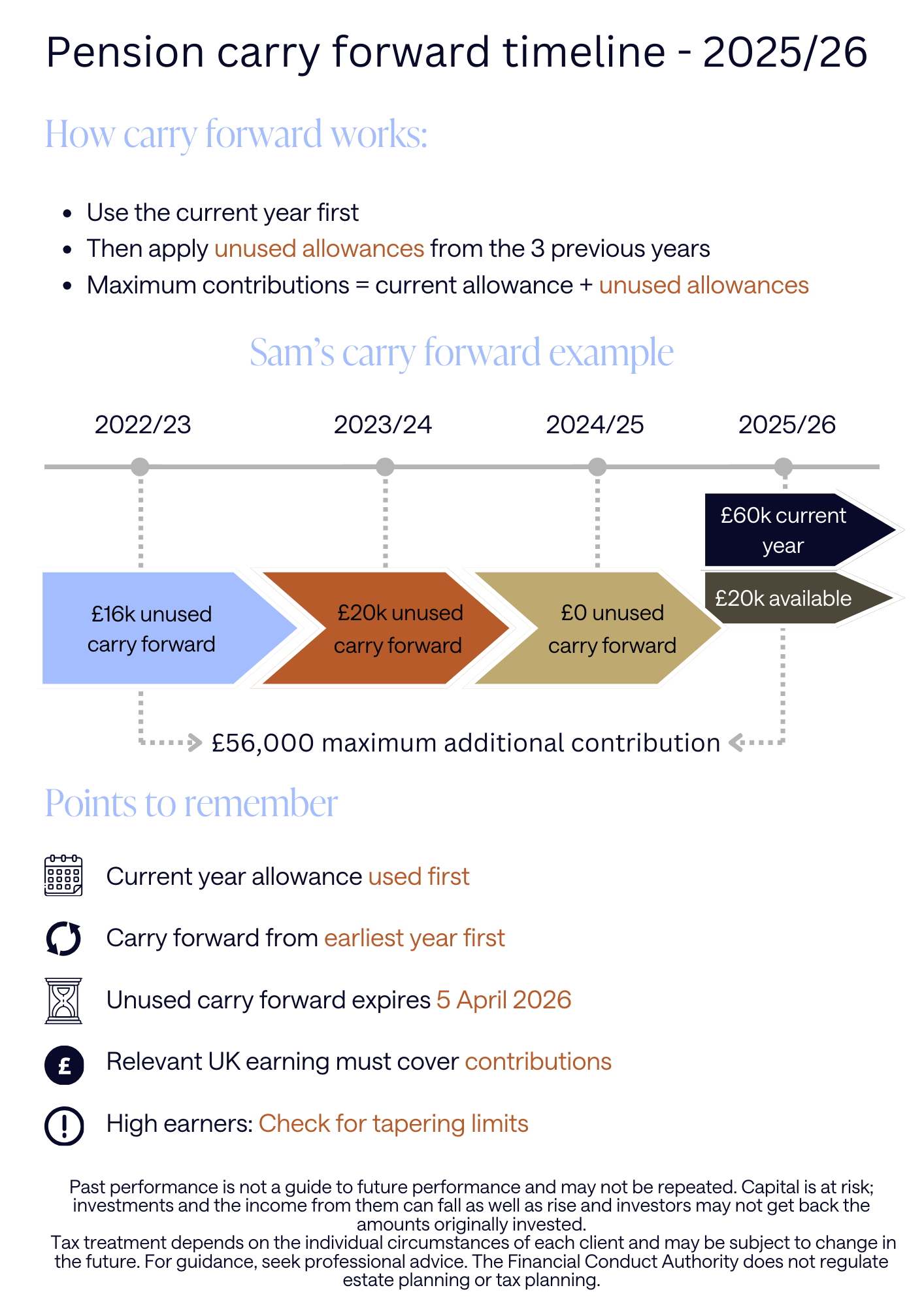

The standard annual allowance is £60,000 for the 2025/26 tax year. Carry forward allows individuals to use any unused annual allowance from the three previous tax years, in addition to the allowance for the current year.

This means that, potentially, up to £220,000 could be contributed in the 2025/26 tax year without breaching the annual allowance, made up of:

- £60,000 for 2025/26

- £60,000 for tax years 2023/24 and 2024/25

- £40,000 for the tax year 2022/23 subject to available unused allowance

Eligibility for carry forward

To be eligible to use carry forward, an individual must have been a member of a registered UK pension scheme in the tax year(s) from which unused allowance is being carried forward. There is no requirement to have made pension contributions in those years; deferred or pensioner membership is sufficient.

The current tax year’s annual allowance must be used first, before any carry forward is applied. Carry forward is then used in chronological order, starting with the earliest available tax year.

Example

Sam has made the following pension contributions and wants to know the maximum additional contribution they could make in the 2025/26 tax year.

| Tax year | Annual allowance | Contributions | Carry forward available |

| 2022/23 | £40,000 | £24,000 | £16,000 |

| 2023/24 | £60,000 | £40,000 | £20,000 |

| 2024/25 | £60,000 | £60,000 | £0 |

| 2025/26 | £60,000 | £40,000 | £20,000 remaining |

Sam has £20,000 of unused annual allowance available for 2025/26. They can then add:

- £16,000 from 2022/23

- £20,000 from 2023/24

This gives a maximum additional contribution of £56,000, allowing total contributions of £96,000 in the 2025/26 tax year without exceeding the annual allowance.

If Sam does not make use of the £16,000 available from 2022/23 before 5 April 2026, this amount will be lost, as carry forward only looks back three tax years.

Earnings requirement

Where personal contributions are being made, the individual must have relevant UK earnings at least equal to the gross contribution amount in the current tax year in order to receive tax relief. In Sam’s case, this would require earnings of at least £96,000 in 2025/26.

It is not possible to carry forward unused earnings — only unused annual allowances.

Exceeding the annual allowance in earlier years

If an individual exceeded their annual allowance in one of the previous three tax years, it may be possible to offset that excess against unused allowance from an earlier year.

For example, if Sam’s contribution in 2023/24 had been £70,000 rather than £40,000, the £10,000 excess would need to be tested against any unused allowance from 2022/23 to determine whether an annual allowance charge arises.

High earners and the tapered annual allowance

Where an individual is, or has been, subject to the tapered annual allowance, the tapered allowance must be calculated separately for each relevant tax year.

For 2025/26, tapering applies where:

- Threshold income exceeds £200,000, and

- Adjusted income exceeds £260,000

The annual allowance is reduced by £1 for every £2 of adjusted income above £260,000, subject to a minimum annual allowance of £10,000.

For tax years 2020/21 to 2022/23, the adjusted income limit was £240,000, meaning carry forward from those years may be more restricted for individuals affected by tapering.

For tax years prior to 2020/21, tapering was based on:

- Threshold income of £110,000, and

- Adjusted income of £150,000

Money Purchase Annual Allowance (MPAA)

Where an individual has triggered the Money Purchase Annual Allowance, their annual allowance for defined contribution (money purchase) pension savings is reduced to £10,000 per tax year.

No carry forward is available in respect of defined contribution pension savings once the MPAA has been triggered. However, carry forward may still be available in relation to accrual under a defined benefit pension scheme, subject to the usual rules.

If you would like to discuss pension contributions, carry forward, or how these rules apply to your individual circumstances ahead of the end of the 2025/26 tax year, please contact us.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. For guidance, seek professional advice. The Financial Conduct Authority does not regulate estate planning or tax planning.

Date written: 29th January 2026

Approved by Evolution Wealth Network Ltd on 10/02/2026.